Is Every Company Becoming a Software Business?

The great convergence to "X-as-a-Service" business model.

*Brand Anatomy publishes every other week*

It’s without a doubt the sexiest business model out there right now. From Stanford dropouts to seasoned entrepreneurs diving head first into building the next big thing in software. For many, the promise of securing a multi-million dollar exit to then become a casual board observer of five companies is quite alluring indeed. For others, they have a genuine passion for it. Then there’s those that fall somewhere in between. Regardless of a founder’s motivations, one thing holds true - there’s been an explosion of software companies over the last two decades.

The Hype is Far From New

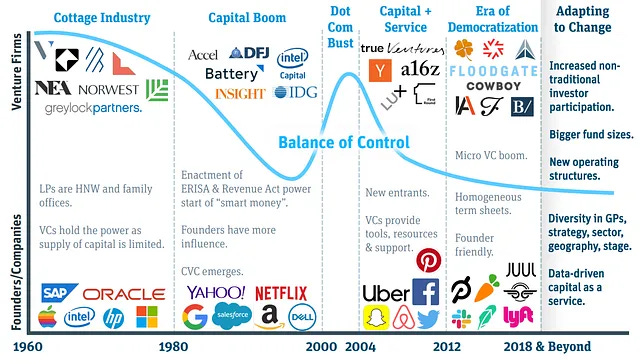

Being a SaaS business is the “hot new thing”; however, this hype is far from “new”. It started in the dot com era, then crashed and burned, then came back soaring even higher during peak of COVID. Today, this phoenix is flying back down to ground level. We likely won’t see what see saw during early 2000s so this ground level is a few floors higher. There’s a few reasons for this:

We know what we’re doing just a (little) bit more and some of us have more scar tissue than others to prove it

Tech investing knowledge has increasingly become democratized and the value of being a tech or SaaS focused VC firm is eroding

We have more tools under our belt as it relates to funding channels (equity, venture debt, SAFEs, bridge rounds etc.).

Business Model Matrix

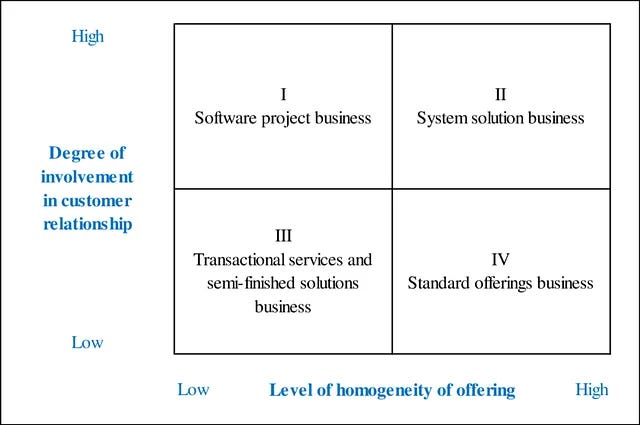

Software businesses are ubiquitous because they either i) create something new or ii) digitally transform an antiquated workflow or process. While many tools help companies become digitized it doesn’t mean it’s a software business.

While many tools help companies become digitized it doesn’t mean it’s a software business. A company’s business model can be roughly divided into the below matrix based on degree of involvement in customer relationship by the level of homogeneity of offering. Many businesses are in top and bottom left quadrants (professional services, consulting, transactional marketplaces); however, they pose as businesses on the right. The reason is that software businesses are highly scalable and predictable given the subscription-based model which makes them great for fundraising from investors.

Everything-as-a-Service

Virtually every business is marketing themselves as “X-as-a-service” (fill in the blank for X). Whether it be software, data, hardware, ransomware, platform or even knowledge as a service…the list is virtually endless. For the highly-curious, a (non-exhaustive) list of the XaaS business model universe can be found here.

During the dot.com bubble of the early 2000s startups began adding internet-related prefixes (a la cyber-, e-, info-, net-, techno-) to disguising themselves as tech companies. Many investors were eager to invest at valuations that were ludicrous when looking at a company’s fundamentals such as revenues, operating margins, unit economics, cash flows, and PE ratios. VCs and other institutional investors were investing in future potential that was not rooted in any historical performance or track record. It was akin to throwing a dart blindfolded.

Tech businesses, then and now, garner premium attention, multiples, and media coverage. VC’s went all in on SaaS during COVID and significant portion of that was due to fear of missing out on the “next big 20x ROI” investment opportunity. however, not all investments panned out that way and we’re seeing a reversal in the market today.

Elon Musk Might Have a Point

There does seem to be a fear of asset heavy industries with a high concentration of talent going into software. An overwhelming number of new startups are SaaS businesses. Despite all the controversy surrounding Elon Musk and his stance on many topics, he put it well in a Tweet from April 2023:

“Once prominent, they’re one of the few to have succeeded. Too much talent is chasing software, much like Hollywood has too much talent chasing acting. It’s silly to have 10 talented entrepreneurs all chase same SaaS niche when they could be epically successful in heavy industry.”

There’s a ton of great SaaS platforms out there but some are really products aiming to be standalone platforms in where their troubles with customer retention, scale, and profitability lie. That’s also why in 2021 the seasoned investor Marc Andreessen proclaimed that “software is eating the world”.

The Data Supports It

The data supports it. We went from 25k software companies globally in 2021 to 30k in 2023 and a projected 72k by 2024. That’s a staggering 3-year increase. 60% of these companies are based in the U.S. (given most of the VC dollars are out of Silicon Valley). SaaS makes up ~70% of the software used today. There is not one company that dominates the market, however, the top five largest SaaS players have a combined 30.5% market share.

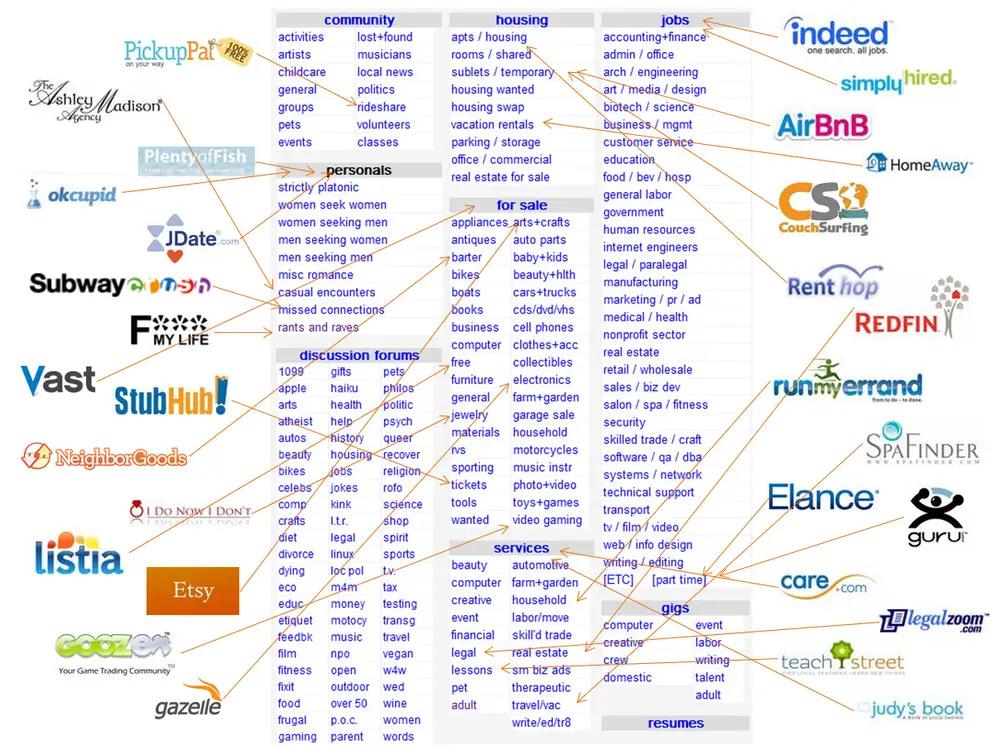

The Great Craigslist Unbundling

In 2014, Andrew Parker of Spark Capital wrote about how Craigslist gave birth to dozens of software companies that took on a niche / industry sub-vertical and made it into a standalone platform. From AirBnB and indeed to Redfin and Etsy. All of these trace their lineage back to Craigslist. Craiglist had two main issues that these “break-off” companies solved for:

Craigslist was a “jack of all trades master of none”. The newer platforms it gave birth to doubled down and got really good at one / a few things.

There is little security and certainty when it comes to transacting on Craigslist. It’s essentially a “faceless” platform. Newer platforms solved for this with customer support teams, secure payments portals, and data privacy certificates (GDPR, CCPA) - all to reduce friction and make the consumer feel safe and comfortable with using the platform. Say you book a vacation rental - no customer service to reach out to if you experience issues and no guarantee you won’t be scammed. AirBnB offloaded the risk from the customer.

Superior UX / UI and Product - Craiglist was a simple marketplace that connected sellers <> buyers. It didn’t have the same VC-backing of these platforms which means it couldn’t invest in R&D or S&M. Craigslist did not take a percentage cut of transactions made on its platform like Etsy or AirBnB do.

What do you think? Is this concern overblown? Is every company truly becoming a software business or is it simply adding a layer of technology to its current product / service?

Hey, how come you stopped writing this newsletter :)?